Is ChatGPT Solving Inflation? Consequences of The Great Economic Reversal

Could GPT-4 deflate prices by 100x, provide crypto welfare for the unemployed, and end taxes?

TL;DR

Don’t just fear inflation, prepare for deflation as a possibility.

The Great Deflation of 1870-90 holds clues for organizing and adapting society in an Industrial Revolution.

Save money.

Brace for massive 10x productivity leaps; 20-30% compounded annual productivity growth is plausible.

A reversal of the inflationary paradigm upends our debt-based economic system.

Horsepower, horsepower

All this Polo on, I got horsepower.

— 2Chainz, Mercy

I. The Biggest Thing Since “Fire”

While many worry about inflation, we may be on the verge of multi-decade hyperdeflation.

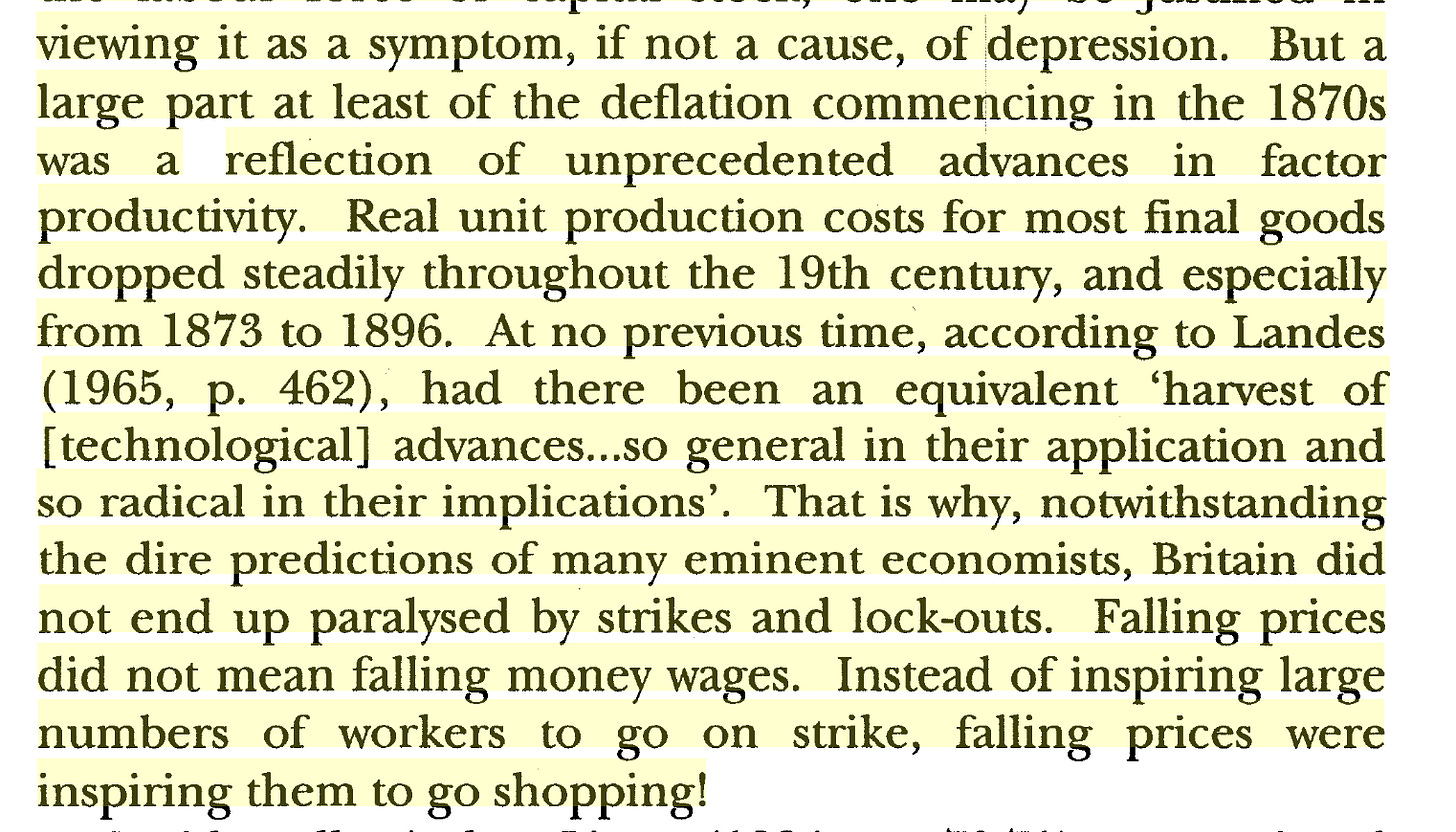

The world is changing in ways that haven’t happened in our lifetimes, but have happened many times in history.1 Let’s take a look the Great Deflation of 1870-90, a period of transformative technological progress driven by the Second Industrial Revolution.

Prices fell by 1/3 over two decades,2 yet real incomes actually increased!3

The steam engine—inanimate power—was the base-layer innovation that drove productivity up and prices down (“deflation”).

Before, progress was shackled to muscle; today, progress is shackled to intelligence. And GPT-N may replace our brainpower as the “steam” that once replaced our muscle power.4

II. The Inflationary Regime May Be Over

We may already be experiencing disinflation. And on this precipice, GPT-driven progress can lead to a dramatic drawdown into deflation for decades.

Inflation may already be over

The last CPI headline print was 6%. The rise in shelter costs drove 70% of that annualized rise despite only being ~34% of the overall basket.

However, if we replace the CPI shelter basket with a more realtime shelter index, inflation runs at about 2.5% annualized, not far from a 2% target:

We can triangulate the CPI with a different inflation index, Truflation, which reports inflation under 4% and is trending down rapidly:

Also, if we do experience a banking crisis, it should lead to lower demand as credit shrinks, which is disinflationary:

Against this backdrop, the Fed has hiked at the fastest rate in history:

Yet, per Friedman, “monetary actions affect economic conditions only after a lag that is both long and variable”—and Raphael Bostic notes from the Federal Reserve Bank of Atlanta that it could take “18 months to two years or more for tighter monetary policy to materially affect inflation.”

Even though the full effects of the Fed’s unprecedented rate hikes have not yet been felt, excessive inflation may be old news.

And all this is before GPT-4.

Deflation, Good and Bad

“Good” deflation refers to productivity increases so dramatic that prices fall. Bad deflation refers to the rapid decline of demand.

The deflation starting in the 1870s was good deflation. Indeed, 90% of deflationary episodes did not have depression.5 Productivity advances in chemistry, electricity, transportation, and the production of new materials drove prices down6:

According to Bill Gates, advances like GPT-4 in AI will push productivity up in areas like health and education. These happen to be the most egregious drivers of inflation over the past couple decades:

Marc Andreessen notes that artificial constriction of supply due to regulation drove prices up in healthcare and education. GPT-4 floods these supply-constrained markets with an instant glut of highly qualified, essentially zero-cost professionals in healthcare in education, reversing the secular support to inflation over the past several decades and dropping the floor out from under the price index.

And perhaps quality could even go up. GPT-4 has already saved a dog’s life where a veterinarian couldn’t:

In economics, growth in total-factor productivity conceptually is growth in technology, or how we can produce more with less.7

For example, fire (as a technological advancement) increased TFP by allowing humans to derive more benefits from the same inputs (food/materials and time). Fire can be used to caramelize a crème brûlée, but also to smelt aluminum.

GPT, as technological fire, enables us to produce more with less: it can unlock cheaper energy and save lives, but also serve as an infinitely patient and infinitely knowledgeable professor to billions of people simultaneously.

What might the magnitude of TFP gains be? As an example, steam was a boon to TFP, deflating production costs by 2% per year for decades. With GPT-4, I am already noticing significant time savings on research, communication, and software engineering; my estimate is gains north of 50%.

And all the while, progress is accelerating. Plugins give GPT digital arms. And GPT-5 could finish training in December. These efficiency gains could compound for years.

To ballpark, the Great Deflation of 1870-1890 lasted for about 20 years, but annual deflation only ran at about 2%; if this Revolution lasts 20 years and increases factor productivity by about 25% (just an estimate), we could expect:

A $50,000 car today to cost $160 post-Reversal.8

A $1299 computer today to cost $4 post-Reversal.

A $5 latte today to cost $0.02 post-Reversal.9

III. The Reversal: Infinite Wealth, No Taxes, and Worldcoin UBI

The inflationary regime today is like a constant in a program we never thought would turn into a variable. The reversal of this core assumption leads to non-obvious consequences:

The end of taxes: As governments face the challenge of maintaining demand in a deflationary environment, they will likely turn to redistributive policies, cutting taxes to stimulate aggregate demand.

The Tipping Point: There is a tipping point of a small amount of money today that, because of compounded real growth, ensures you never need to work again. My rough estimate is $20k.10

Crypto-UBI: To prevent widespread unemployment and unrest, initiatives like Worldcoin, co-founded by Sam Altman, could provide a universal basic income, ensuring financial stability for all.

OpenAI LP and WorldCoin

The greatest risk is massive, widespread unemployment.

Large-scale structural unemployment leads to violence. In the Industrial Revolution, the original Luddites rebelled violently against loss of their ways to make a living:

The protest also blossomed into violence as it grew in size. In addition to smashing machines, Luddites set mills ablaze and exchanged gunfire with guards and authorities dispatched to protect factories.

Four Luddites were shot dead in April 1812 after breaking down the doors of the Rawfolds Mill outside Huddersfield.11

Fortunately, the man spearheading the AI revolution, Sam Altman, also co-founded the best chance we have to actually distribute a universal basic income to prevent widespread chaos and destruction. Worldcoin recently passed more than one million signups.

Worldcoin obtains Sybil-resistant proof-of-humanity and proof-of-uniqueness by scanning your eyeball and associating it with a crypto address. One address, one person. It is extremely difficult to verify humanity in a world dominated by AI, and Worldcoin would be perhaps the only payment rail that could guarantee proof-of-unique-human.

If we were to use Worldcoin to distribute a global dividend, where would the money come from? Perhaps OpenAI Nonprofit.

OpenAI is a capped-profit company that is owned by a nonprofit; after the cap, the value captured accrues to the nonprofit:

My hope—and it is just a hope—is that OpenAI Nonprofit distributes excess profits through Worldcoin so we can avoid chaos from structural unemployment.

I believe it is existentially important that a capped-profit company like OpenAI LP is currently leading the race, versus an uncapped for-profit enterprise.

Without Worldcoin, we wouldn’t be able to ensure proof-of-humanity in an AI-dominated world. Without the capped profit structure, OpenAI would not be incentivized to distribute to Worldcoin. And without crypto, Worldcoin would likely be impossible.

Print To Worldcoin?

Inflation is good for debtors because it reduces the real value of debts, making them easier to pay off. And Uncle Sam is an enormous debtor, to the tune of thirty-one trillion dollars:

There are only a few levers available to avoid debt deflation. Even Alan Greenspan, in The Age of Turbulence, was unsettled by deflation: the obvious lever of just “start[ing] up the printing presses and creat[ing] as many dollars as would be necessary” did not seem to work in Japan.

To prevent the real value of debt from growing due to deflation, governments will need to spur aggregate demand and pursue unconventional monetary policies, like massive QE, yield curve control, and helicopter money. And perhaps distribute newly printed money through Worldcoin.

IV. Conclusion

Fire, steam, intelligence: AI is the base layer disruptor.

GPT is poised to revolutionize every industry, paving the way for an age of abundance. However, the path to this future is uncertain, and the risks lie in uneven hyperdeflation.

The challenge lies in ensuring that humanity enjoys the massive wealth creation brought by AI, rather than locking it away for a select few. The solution may lie in the hands of the same people creating the risks.

Will Prometheus share the flame?

Thank you to Ale from Jur and Chris from Frens Capital for reading and providing feedback on an early draft!

I believe the world is changing in big ways that haven’t happened before in our lifetimes but have many times in history…

— Ray Dalio, Principles for a Changing World Order (link)

Specifically, the development of electrical power and the telephone, the expansion of railroad and telegraph networks, the mastery of submarine cables, the invention of the internal combustion engine, and the production of new materials such as steel and chemicals.

Roughly:

Unless you buy from Starbucks, in which it will cost you $15 or three Macbooks.

It’s rough math, based on a lot of assumptions (like a -25% CAGR and a $5m equivalent nest egg for retirement). But, roughly: