Sovereign Unicorns: Jiaolong, A $1 Billion Private City in China

Could the next unicorns be private cities? A primer on a 120,000-resident, $5 billion GDP private city experiment in China, plus valuation models on network states.

In 2020, Marc Andreessen noted American cities deteriorated to the point that Westworld had to go to Singapore to film what was supposed to be the American city of the future.1

It is time to build, as Andreessen notes; the question is what do you build? A housing company? A manufacturing company?

What if you could innovate on the substrate beneath all companies?

What if you could build a new city?

From Producing Rice to Producing Billions of Dollars

Jiaolong Company may be the most interesting company you’ve never heard of. Jiaolong is a private enterprise that has built a phenomenally successful private city in China from scratch in just a few years.

Here are some quick hits, from papers, interviews, and information from the Chinese internet:

Jiaolong produces $3.2 billion annually in GDP (¥20 billion)2

120,000 citizens live in Jiaolong3

Jiaolong builds and operates infrastructure (e.g. sewage, roads), schools, and public services (e.g. police, hospitals)—even malls and hotels—that American cities struggle to build

How does it work?

Dual Concessions

Jiaolong was founded in 2004 by way of a contract with the Shuangliu County government.

In return for investing in the requisite infrastructure, Jiaolong Co. was granted two key concessions by the government:

Planning rights, which covers land use, and

Tax sharing, which aligns the incentives of Jiaolong Co. and the county government.

Planning Rights are Shared Sovereignty

Zoning and land use are restrictions the government places on land use. By acquiring planning rights from the government, Jiaolong Co. becomes a limited sovereign within their territorial demarcation, thus cutting down on the friction needed to capitalize on opportunities and deliver the results expected of it.

Professor Qian Lu notes an example below. As Jiaolong drew in additional residents, it invested in services and entertainment as it saw fit, and successfully at that:

Contrast this with the onerous California’s ADU restrictions handbook4 and the NIMBY-ism5 that makes “it’s time to build” into “building takes too much time,” if building is at all permissible. The government owns planning rights by default.

But by conceding planning rights to Jiaolong, it has exacted an enormous gain for startup societies at large. In return for unsexy, difficult, and expensive investments in infrastructure, private companies share sovereignty with public governments:

Sovereignty is a continuum. As the entrepreneur’s circle of competence grows, and the government’s competence goes down the drain,6 more of the state’s functions get eaten by entities like Jiaolong Co. and network states. (For clarity of reading, I will elide “Jiaolong Co. and network states” when talking about sovereignty in the rest of this essay, and only refer to “network states”.)

In return for responsibility and results, network states get land, partial sovereignty, and revenue.

Jiaolong blazes the trail for this shift: not only does it have planning rights, but it has built a private school,7 a hospital, a police station, and roads.

In other words, as a private company, Jiaolong Co. has eaten the state’s role in:

education

healthcare

rule of law

transportation infrastructure

These are state functions that were once held dear; indeed, some would argue operation of these functions is what defines a state. Of course, Jiaolong needs to be compensated for these responsibilities, just as the state is compensated for providing (and also not providing) basic services: in taxes.

No Taxation Without Wealth Creation

Where planning rights enabled innovation and building, an innovative tax-sharing plan makes the arrangement sustainable.

The tax-sharing agreement is tiered and incentivized:

If Jiaolong Co. achieves a ¥100 per square meter tax rate, then it can take 25% of taxes produced;

If Jiaolong Co. achieves ¥80 per square meter tax rate, then it can take only 20% of taxes produced.8

To incentivize companies to hit these tax goals, Jiaolong Co.:

Requires firms doing business in Jiaolong to pay an additional payment if under a specified tax target

Incentivizes good performance and payment with tax rebates if above a target;

Also waives tuition for the children of entrepreneurs to attend Jiaolong’s private school.

Not only does Jiaolong have the responsibility of a state (albeit at a small scale), it also gets paid like a state.

The credit cannot all go to Jiaolong (and its founder, Yujiao Huang). The state makes all of this possible. Indeed, the Chinese state is uniquely competent, with strict KPI-equivalents scored by unbiased evaluators.9

However, even a competent state cannot beat out a motivated and resourceful entrepreneur. Jiaolong’s population density is 3.5x that of the surrounding county; its taxation per unit area is 4x and its employment per unit area is 23x (!) a nearby state-managed special economic zone (Xihanggang Economic Development Zone, also in Shuangliu).10

The Hegelian dialectic is one way to think through a potential evolution of governance:

Thesis: the government should manage all affairs of the state, as smart and competent officials.

Result: rare competent cases (PRC), myriad competence-limited cases (USA, UK)

Antithesis: the government should manage as little of the state as possible, and cede control to great individuals.

Result: tragedy of the commons

Synthesis: the government should conduct scoped shared-sovereignty experiments with talented entrepreneurs.

Jiaolong is but one result of the synthesis of shared sovereignty.

How much is Jiaolong worth?

I’ve pulled out relevant data from Professor Qian Lu’s paper and Jiaolong’s website, and done some rough calculations. There are limitations here given Jiaolong is a private company, not a public one, and thus not subject to the strict regulatory filings of a public company.

All errors are mine, and this is not intended to be investment advice.

Here is the table:

A few notes here to help walk through the table:

The salient elements below for the calculation of revenue in USD (second row from the bottom) are:

Annual tax

Area, in square meters

Average CNY/USD exchange rate for the relevant years

The reason we need the area in square meters is Jiaolong’s revenue is based on the aforementioned incentivized tiered schedule. If Jiaolong posts more than 100 yuan per square meter, it can take 25% of taxes collected, which was the case in 2022 (but not in 2014).

The revenue seems small in absolute terms, but also keep in mind this city only has 100,000 people (about the size of San Mateo, CA11) and is still growing (at about 8.5%).

We can triangulate the revenue with ARPUs (Average Revenue Per User; credit to The Network State team I work with for the idea, esp. Balaji, Xen, and Jake).

Twitter’s ARPU is roughly $2012

Jiaolong’s ARPR (Average Revenue Per Resident) is roughly $200

The implication is that, for network states, “revenue parity” with existing social networks can be achieved with an order of magnitude fewer people than such social networks.

Credit to Xen for this insight.

One further note: Jiaolong is located in China, whose GDP per capita is 18% vs that of the USA.

If we adjust for this—not for Jiaolong’s purposes, but for mocking out a Jiaolong clone in a developed, high-income country—we get a GDP per capita-adjusted ARPU of $1,060.

This roughly checks out, because tax is based on income; this GDP adjustment is an income adjustment, and taxes should also increase proportionally.

Calling out an important implication for the last point:

Assuming a 10x revenue multiple, you would only need 100k people living in a first-world network state to achieve a billion-dollar valuation.

This is squarely within the realm of possibility. Jiaolong has hit 100k+ residents already. To triangulate from another angle, NFT communities—often tight-knit, financially incentivized, and socially prominent—are already hitting a similar order of magnitude: Bored Ape Yacht Club (BAYC)13 and Mutant Ape Yacht Club (MAYC)14 together command almost 20,000 holders (not including ApeCoin); Meebits by Larva Labs (creator of CryptoPunks) has a theoretical max community size of 20,000 (assuming one NFT per person, which is an assumption that can be broken with fractionalized NFTs)15; Axie Infinity has 125k players live right now, at the time of writing.16

Billion-dollar network states are coming, and they only need a hundred thousand people each.

Valuation as a Perpetuity

I’ll include a couple other quick checks on Jiaolong’s private valuation given publicly available information.

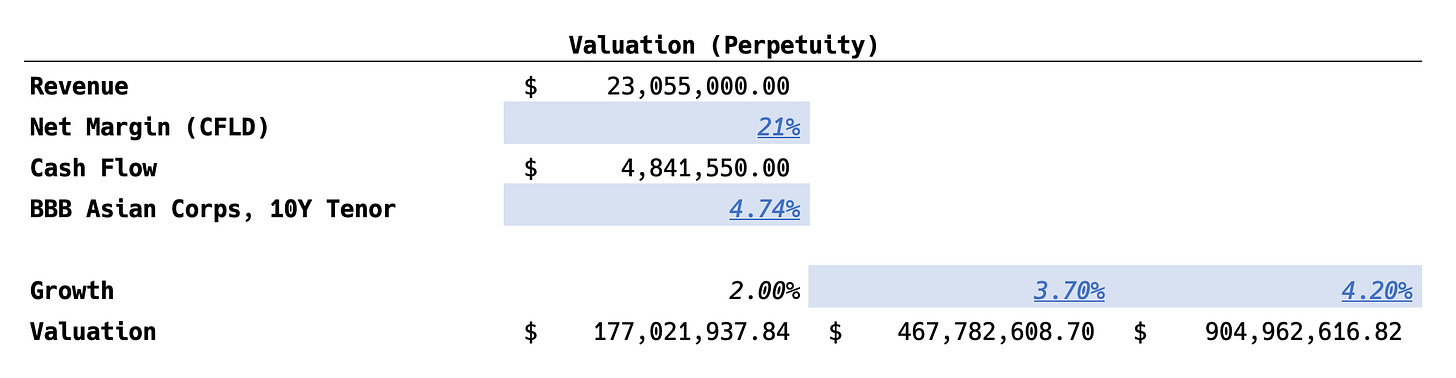

A quick perpetuity/dividend discount growth rate model based on a comparable net profit margin from CFLD (a Chinese private city operator) and the current yield for 10-year tenor BBB-rated Asian corporates, according to Fitch:

Obviously, this valuation of Jiaolong as a perpetuity is sensitive to growth rates. Some notes below:

Three values are included to outline the sensitivity of Jiaolong to rates

2% is a base-case developed country growth rate

3.70% is modeled as the bear case for a growth rate for China in the next decade17

4.20% is provided as a more optimistic case, under the assumed 4.6% estimate

The growth rate for the resident country is the top-case growth rate for the terminal value in perpetuity

To square with recent performance, Jiaolong has posted 8%+ CAGR the past 7 years.

Valuation as Discounted Cash Flows

Again, this valuation is done on somewhat of a time and data budget: Jiaolong is a private company and its financials have to be somewhat inferred; we don’t know what their cost of capital is; and we don’t know how their expenses are structured between fixed/variable costs. All of these can affect projections significantly.

To offset this somewhat, I’ve included another point of triangulation below, which takes the comparable net margin from CFLD and discounts the cash flows at the aforementioned BBB-rated Asian corporate yield.

The actual discounting of the cash flows is relatively straightforward, using most of the same numbers as above. “PV” stands for Present Value, and “CF” stands for Cash Flow.

Because the terminal value is such a whopper, I triangulated it between a conservative liquidation value (infrastructure cost), the breakeven investment made, and three more perpetuity-based valuations of the final cash flows in year ten.

I include each Total on the bottom, as well as an average of all five totals ($700mm).

Valuation Implications for Population

As mentioned above, a developed-world network state at a 10x revenue multiple could hit sovereign unicorn status at 100k people.

Valued alternatively (DCF above), a non-developed-world network state would need roughly 170k people to hit a billion-dollar valuation.18

Regardless, we are talking about hundreds of thousands of people coming together for a grand experiment in sovereignty and governance—simultaneously a massive, yet achievable scale. The first sovereign unicorn need not be a million-person state—a hundred thousand is enough.

Conclusion

Technology has allowed us to start new companies, new communities, and new currencies. But can we use it to create new cities, or even new countries?

Balaji Srinivasan, How to Start a New Country

Is Jiaolong a network state? Certainly not: it has no moral innovation, nor diplomatic recognition, nor other major components of a network state.19

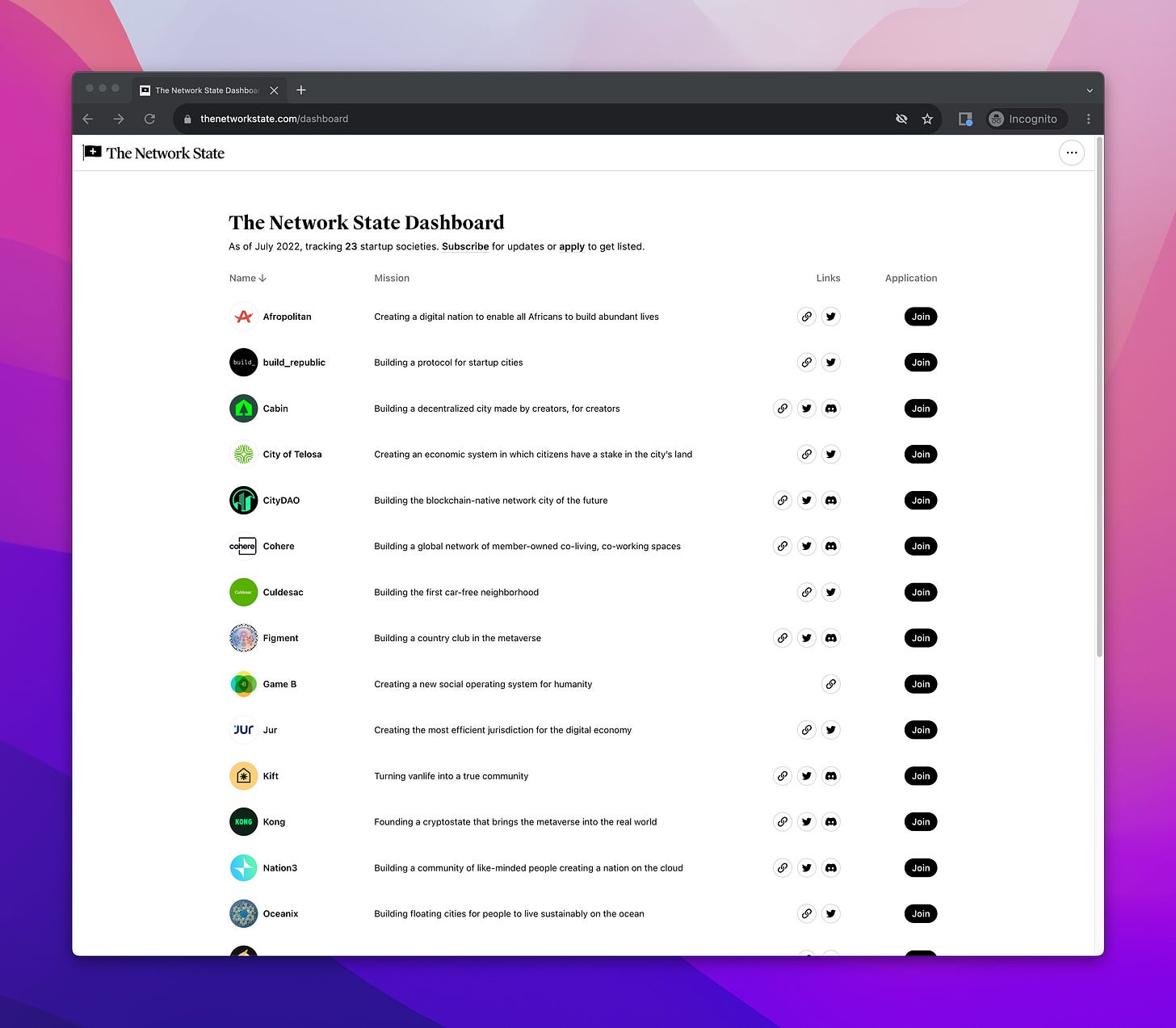

But it can chart a path forward for the 23+ aspiring network states out there. It provides the financial and logistical precedent where there was none before. It pioneers a shared-sovereignty model where the state and entrepreneurs are not pitted together, but work in tandem to create new cities, and eventually, new countries.

And if you’d like a 12,000-page PDF of speeches, rallies, and writings by Lee Kuan Yew, father of Singapore, scraped from the Singapore National Archives, check it out here:

When the producers of HBO’s “Westworld” wanted to portray the American city of the future, they didn’t film in Seattle or Los Angeles or Austin — they went to Singapore.

Marc Andreessen, It’s Time to Build

http://www.jiaolong.cn/main/paperview/1717.html#page/2

I’m not sure what happens if the tax rate falls below 80 yuan per meter squared.

Assuming value accrues at least linearly, $1 billion / ($711 million / 120,000 people) = 169k people.

Very interesting!

Awesome to see classic valuation methodologies applied to Network States. What revenue models do you see most likely for Network States? What value should taxes capture? Especially when thinking about pre-real estate NS?